Why Understanding TER is Crucial for Investors

When it comes to making smart investment decisions, one of the most overlooked factors is the Total Expense Ratio (TER) review. Investors often focus on returns but forget that the costs of managing an investment fund can significantly impact overall performance. In this article, we’ll break down what the TER is, how it works, and why it matters to your investment portfolio. Understanding TER can help you make more informed decisions, save money, and boost your long-term returns.

What is the Total Expense Ratio (TER)?

The Total Expense Ratio (TER) is a metric used to measure the total cost of managing an investment fund. It includes management fees, operating expenses, and other costs incurred in running the fund. Expressed as a percentage of the fund’s assets, the TER shows how much of your investment goes towards covering these fees each year. A lower TER means fewer costs and more returns in your pocket.

Components of the TER

The TER consists of several different costs that an investment fund incurs. Here’s a breakdown:

Management Fees

These fees are charged by the fund manager for overseeing the investment portfolio. Management fees are typically a fixed percentage of the fund’s total assets.

Administrative and Operating Costs

These include everyday expenses like legal fees, audit costs, and marketing expenses. Administrative costs can vary depending on the size and complexity of the fund.

Transaction Costs

Every time a fund buys or sells assets, it incurs transaction costs. These fees are usually include in the TER and affect the fund’s overall performance.

Other Expenses

Some funds may also charge additional fees, such as performance fees or distribution fees, which are added to the TER.

Why the TER Matters to Investors

Direct Impact on Returns

The TER directly reduces the net returns you earn from your investment. A higher TER means more of your money goes toward paying fees rather than earning returns.

Helps in Comparing Funds

The TER is a useful tool when comparing different investment funds. By looking at the TER, you can determine which funds offer better value for money.

Transparency in Costs

The TER provides transparency, allowing investors to see exactly how much they are paying for the services provided by a fund. This helps investors make informed decisions based on both costs and returns.

How to Calculate the TER

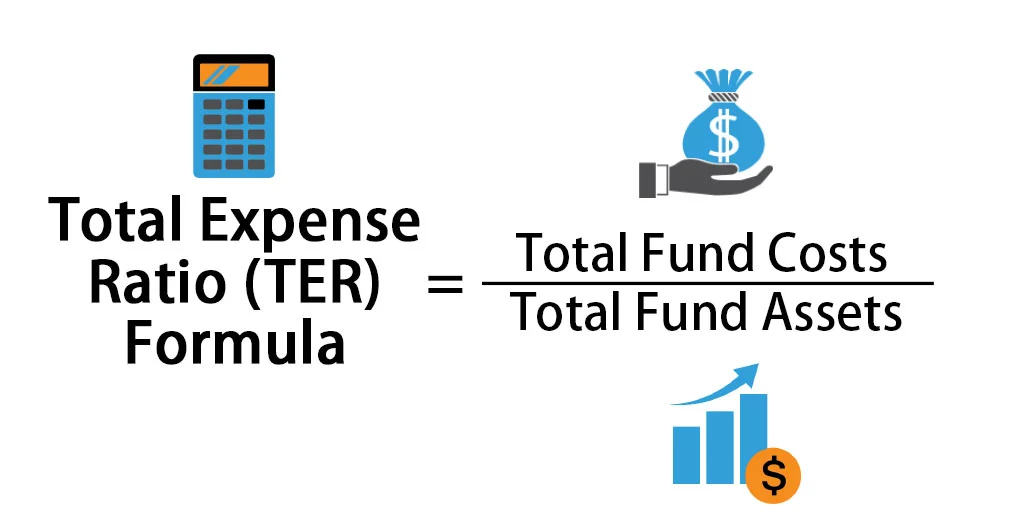

Calculating the TER is relatively straightforward. It is calculated as:

TER=TotalFundCostsTotalAssetsUnderManagement×100TER = \frac{{Total Fund Costs}}{{Total Assets Under Management}} \times 100TER=TotalAssetsUnderManagementTotalFundCosts×100

For example, if a fund has $1 million in assets and the total annual costs amount to $10,000, the TER would be 1%.

Types of Funds and Their TERs

Mutual Funds

Mutual funds typically have higher TERs due to active management and higher operating costs. TERs for mutual funds can range from 0.5% to 2.5%, depending on the fund’s complexity.

Exchange-Traded Funds (ETFs)

ETFs tend to have lower TERs since they are passively managed. The average TER for an ETF is usually between 0.1% and 0.75%.

Index Funds

Index funds, like ETFs, are passively managed and often have the lowest TERs. They typically charge between 0.1% and 0.5%.

Hedge Funds

Hedge funds often have a higher TER due to complex strategies and higher performance fees. H-edge funds may charge TERs above 2%.

How TER Affects Long-Term Returns

The TER may seem small, but it can have a significant impact on long-term returns. For example, consider an investment fund with a TER of 1.5% versus a fund with a TER of 0.5%. Over a 20-year period, the difference in returns could be substantial. Lowering your TER can dramatically increase the amount of money you earn over time.

TER vs. Other Fees: What’s the Difference?

Investors should be aware that the TER is just one of many costs they may incur. Here’s how it differs from other common fees:

TER vs. Load Fees

Load fees are one-time charges, while the TER is an annual fee. Some funds charge both, so it’s essential to be aware of all costs involved.

TER vs. Performance Fees

Performance fees are charged based on the fund’s returns. These fees are typically additional to the TER and may increase total costs if the fund performs well.

TER vs. Management Fees

Management fees are a part of the TER. They cover the cost of the fund manager’s services and usually make up the bulk of the TER.

How to Lower Your TER

Choose Low-Cost Funds

Opt for funds with a lower TER, such as index funds or ETFs. These funds offer similar returns to actively managed funds but at a lower cost.

Avoid Additional Fees

Some funds charge extra fees, like performance or load fees, which can increase the overall cost. Stick to funds that keep fees to a minimum.

Consider Passive Management

Passively managed funds, like index funds, often have lower TERs than actively managed funds. If your goal is long-term growth, these funds may be a better choice.

Look for Fee Discounts

Some fund providers offer discounts on fees for large investments or long-term commitments. Always ask if fee discounts are available.

Frequently Asked Questions About TER

What is a good TER?

A good TER depends on the type of fund you’re investing in. For index funds and ETFs, anything below 0.5% is consider low. For mutual funds, a TER below 1% is generally favorable.

Can the TER change over time?

Yes, the TER can fluctuate based on changes in the fund’s operating expenses or management fees. It’s essential to review the TER regularly to ensure you’re not overpaying for your investments.

Is the TER the only cost to consider?

No, investors should also consider other costs such as load fees, performance fees, and transaction costs. Always review the fund’s prospectus for a full breakdown of fees.

Conclusion: The Importance of Considering TER in Your Investment Strategy

Understanding the (TER) Total Expense Ratio is critical for making smart investment decisions. While it may seem like a small percentage, the TER can significantly impact your returns over time. Always compare the TER of different funds before making a decision, and choose low-cost options when possible to maximize your returns. The lower your fees, the higher your potential returns, making the TER an essential factor in any long-term investment strategy.